content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Bitcoin is entering a critical phase after several days of heightened volatility and market discomfort. The recent sharp price swings have amplified investor concerns, with many analysts warning that a deeper correction could be imminent. Sentiment is shifting, as disbelief in the continuation of the uptrend gains traction among traders and market participants. However, amidst the growing uncertainty, strategic accumulation by institutional players continues to make headlines.

Arkham Intelligence, a leading blockchain data platform, revealed that Metaplanet, a Japanese public company renowned for its aggressive Bitcoin treasury strategy, acquired over $50 million worth of BTC just a few hours ago. Despite the recent price decline, Metaplanet’s latest acquisition underscores its long-term conviction in Bitcoin as a strategic reserve asset, following a MicroStrategy-like approach.

While retail sentiment shows signs of exhaustion, institutions like Metaplanet are seizing the opportunity to accumulate during periods of market weakness. This divergence between institutional accumulation and retail fear will be a key factor to watch in the coming weeks, as Bitcoin navigates this crucial phase that could determine whether the bull cycle continues or enters a prolonged correction.

Metaplanet Expands Bitcoin Holdings to 17,595 BTC

Metaplanet, often referred to as the “Japanese MicroStrategy,” continues its aggressive Bitcoin accumulation strategy. According to Arkham Intelligence, Metaplanet recently acquired 463 BTC worth $53 million, raising its total holdings to 17,595 BTC, now valued at approximately $2.02 billion. This latest purchase reinforces Metaplanet’s strategic focus on Bitcoin as a core treasury asset, mirroring the playbook of MicroStrategy in the United States.

Metaplanet Bitcoin Portfolio | Source: Arkham

Metaplanet Bitcoin Portfolio | Source: ArkhamThe company actively monitors and reports its BTC Yield, a key performance indicator (KPI) that measures the percentage change in the ratio of Total Bitcoin Holdings to Fully Diluted Shares Outstanding over a given period. This metric allows Metaplanet to assess how its Bitcoin acquisition strategy impacts shareholder value, specifically focusing on accretive growth despite share dilution.

Another essential metric is BTC Gain, which represents the hypothetical increase in Bitcoin holdings driven solely by the company’s treasury operations, excluding the effects of share issuance. Additionally, BTC ¥ Gain converts this figure into yen, providing shareholders with a clearer financial perspective in their local currency.

Metaplanet’s BTC Yield has shown staggering performance metrics: 41.7% in Q3 2024, 309.8% in Q4 2024, 95.6% in Q1 2025, and 129.4% in Q2 2025. From July 1, 2025, to August 4, 2025, the company’s BTC Yield stands at 24.6%, reflecting sustained treasury efficiency despite recent market volatility.

This relentless accumulation by institutional players could play a pivotal role in supporting market structure through volatile phases, reinforcing Bitcoin’s growing appeal as a corporate treasury reserve asset.

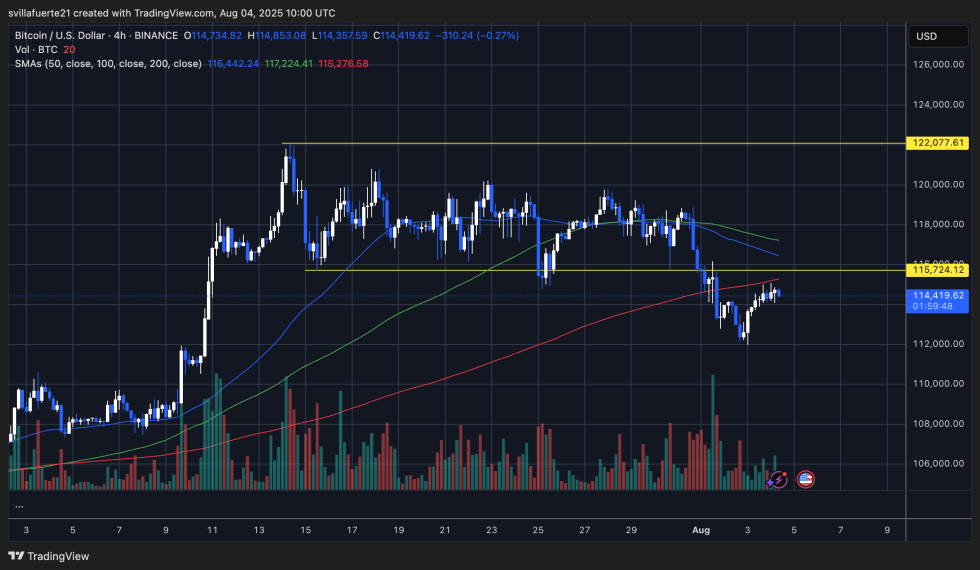

BTC Struggles Below $115K Level

Bitcoin (BTC) is currently trading at $114,419, showing signs of exhaustion after a short-lived recovery attempt from the recent dip to $112,200. The chart illustrates BTC’s rejection at the 200-day moving average (115,276), which has now become a key dynamic resistance. The $115,724 horizontal level—previously acting as range support—is now capping BTC’s upside and proving difficult to reclaim.

BTC consolidates below key level | Source: BTCUSDT chart on TradingView

BTC consolidates below key level | Source: BTCUSDT chart on TradingViewPrice action remains compressed below the 50-day (116,442) and 100-day (117,224) moving averages, adding further resistance pressure. The recent bounce from local lows lacks strong volume, indicating weak bullish conviction and suggesting the move could be more of a relief rally than a trend reversal.

Bulls need to decisively reclaim $115,724 and push beyond the 200 MA to regain bullish momentum. Failure to do so could see BTC retest the $112,200 support level, where the previous bounce originated. A breakdown below this zone could open up further downside towards the $110,000 psychological level.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

English (US) ·

English (US) ·