Key Notes

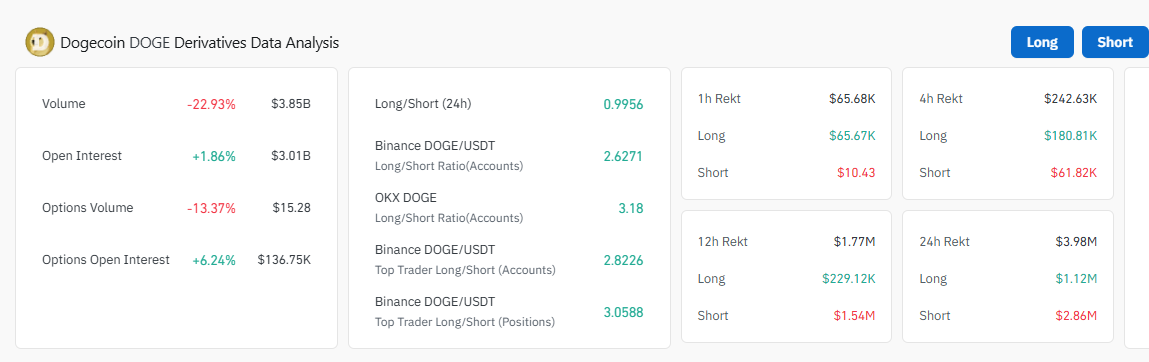

- Trading volume dropped over 20% to $4.14 billion while open interest rose 1.66%, indicating weak speculator participation overall.

- Short contracts exceeded long positions across 1h, 12h, and 24h windows, suggesting traders expect the uptick to be temporary.

- DOGE faces resistance at $0.23-$0.28 range with potential breakout to $0.25 or pullback to $0.18 depending on momentum shifts.

Despite Dogecoin’s 3.5% recovery to $0.205 on August 6, derivatives data suggest the rebound lacks conviction. Daily trading volume in DOGE fell over 20%, dropping to $4.14 billion, highlighting weak participation from short-term price speculators.

More notably, open interest rose 1.66% to $3.05 billion, while short contracts exceeded long positions across all major intraday windows: 1h, 12h, and 24h. This divergence indicates that a majority of new positions were initiated with a bearish bias, as traders expect the uptick to be temporary.

Dogecoin Derivatives Market Analysis | Source: Coinglass

Coinglass liquidation data further confirms this trend. Over the past 24 hours, $4.73 million in DOGE positions were liquidated—$2.72 million from shorts, but a substantial $2.01 million from longs—suggesting bulls are still being squeezed.

On shorter timeframes, short liquidations continue to overshadow longs, with $1.34 million against $65,000 on the 4-hour chart, and $1.66 million against $460,000 over the past 12 hours.

Moreover, top trader accounts also lack bullish conviction despite broader long/short ratios appearing neutral (0.99).

In summary, the Dogecoin market data points toward cautious optimism, with the 3.5% rebound in DOGE spot price being overshadowed by dominant bearish sentiment in derivatives.

However, if broader market catalysts boost buying momentum, the concentration of leveraged short positions could spark a powerful short squeeze, potentially sending Dogecoin surging toward the $0.25 mark.

DOGE at Crossroads: $0.25 Breakout or $0.18 Crash Ahead?

Dogecoin DOGE $0.20 24h volatility: 3.2% Market cap: $30.71 B Vol. 24h: $1.24 B has staged a notable recovery, reclaiming the lower Bollinger Band and establishing support above the critical $0.20 threshold. However, technical indicators reveal a narrow trading corridor ahead. The daily chart shows the upper Bollinger Band forming a formidable resistance ceiling at $0.28, while the median band at $0.23 presents the first major hurdle for any sustained upward momentum.

To confirm a bullish reversal, DOGE must close above the $0.23 level. Affirming this stance, the MACD remains bearish but is gradually flattening out, suggesting momentum could shift if price continues to consolidate above $0.205.

Dogecoin price forecast

If DOGE fails to break $0.228, it risks pulling back toward the lower band near $0.18, which has acted as support during the past week’s consolidation phase. A daily close above $0.228 could trigger a move toward $0.25, fueled by a potential short squeeze if bearish positions are liquidated en masse.

On the flip side, a price rejection at $0.22 followed by high-volume selling could drag Dogecoin back to $0.18.

Solaxy Presale Gains Momentum as DOGE Traders Seek High-Yield Alternatives

As Dogecoin consolidates around the $0.20 level amid mixed trader sentiment, attention is turning toward emerging opportunities that offer stronger upside potential. Solaxy (SOLX), the first Layer-2 solution on the Solana blockchain, could draw DOGE traders looking to diversify ahead of the next altcoin cycle.

Solaxy Presale

To capitalize on the early presale phase before public listing, visit Solaxy’s official site.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dogecoin (DOGE) News, Cryptocurrency News, News, Price Prediction

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·