Bitcoin (BTC) staged a mild rebound from yesterday’s inflation-driven drop to $117,180, climbing back toward $119,000 at the time of writing. A declining leverage ratio suggests the top cryptocurrency’s bullish momentum could persist, keeping it in the running for a new all-time high (ATH) in the near term.

Bitcoin Leverage Ratio Falls, Bulls Rejoice

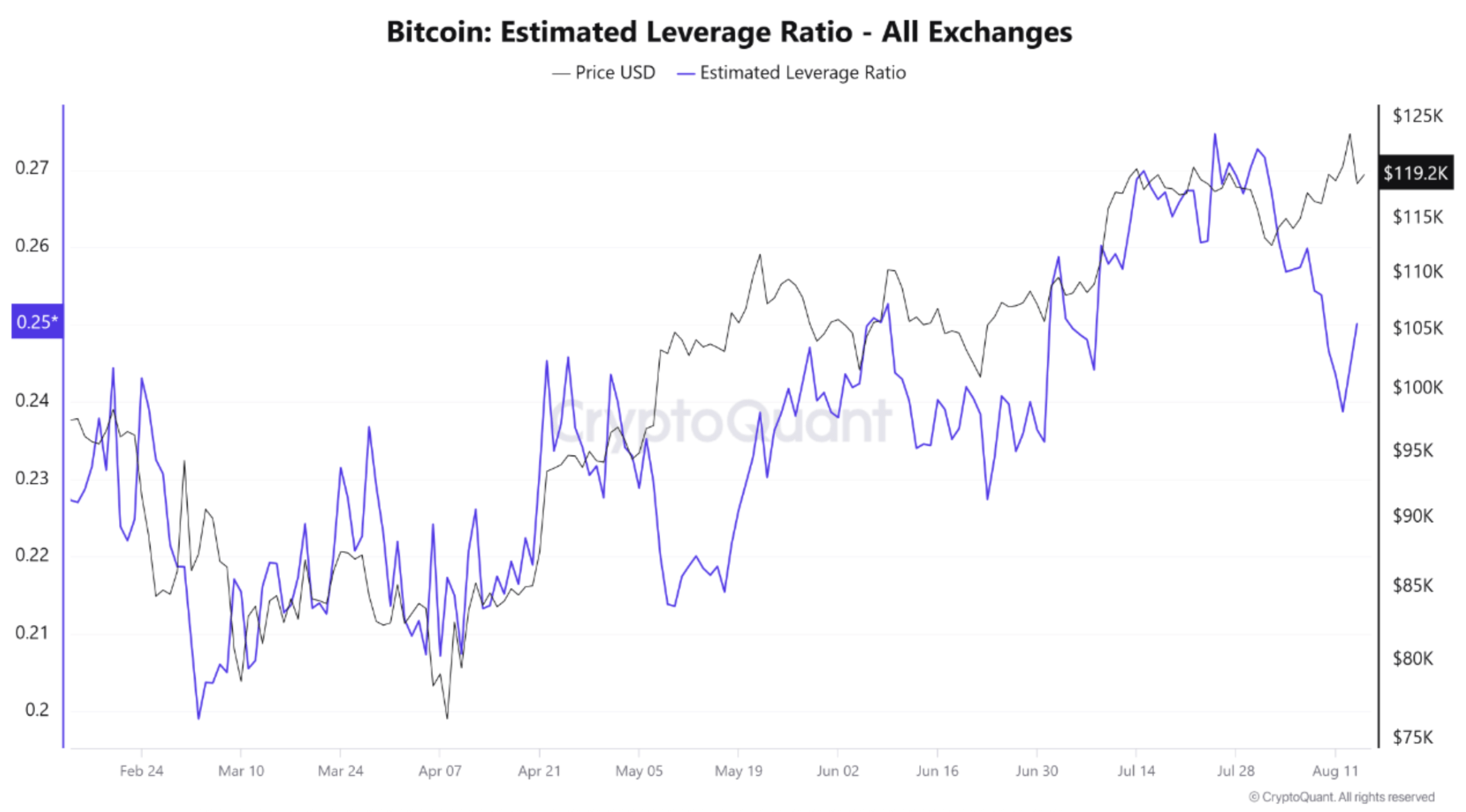

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s leverage ratio across all cryptocurrency exchanges has sharply declined from its late-July and early-August peak of 0.27.

Notably, the ratio dropped to 0.25 in early August before a modest rebound. In contrast, the period from May to late July saw both the price and leverage ratio climb in tandem, signaling an influx of traders opening larger positions.

Source: CryptoQuant

Source: CryptoQuantIn contrast, this time leverage has fallen without a comparable drop in price – a sign that risk has eased since the recent uptrend. Arab Chain notes that this may be the result of high-risk positions being liquidated or traders exiting the market amid volatility.

With BTC holding around $119,000, the lower leverage ratio is a bullish sign, suggesting that the latest price gains are fueled more by genuine liquidity than speculative excess.

A continued decline in leverage could further reduce the likelihood of a sharp correction. Conversely, a sudden spike in leverage alongside a price rally would raise the risk of a pullback. The analyst added:

If leverage remains at moderate or low levels while the price remains stable, this could provide a stable base for a new uptrend. An estimated leverage ratio (ELR) holding between 0.24–0.25, accompanied by a gradual price break above 120K, could indicate a spot-supported upside and a possible extension toward the July highs, with moderate funding and slowly rising open interest.

However, a quick jump in the leverage ratio above 0.27 before or during a test of $120,000–$124,000 could signal high liquidation risk and the potential for a sharp downward “shakeout.”

On-Chain Data Points To Potential Selling Pressure

While lower leverage is encouraging for Bitcoin bulls, on-chain data – particularly rising exchange reserves and whale transfers – hints at possible selling pressure ahead.

For instance, Binance’s BTC reserves have recently surged to 579,000, raising concerns of profit-taking after Bitcoin’s recent rally to a fresh ATH. Likewise, more BTC miners are moving their holdings to Binance, potentially preparing to sell.

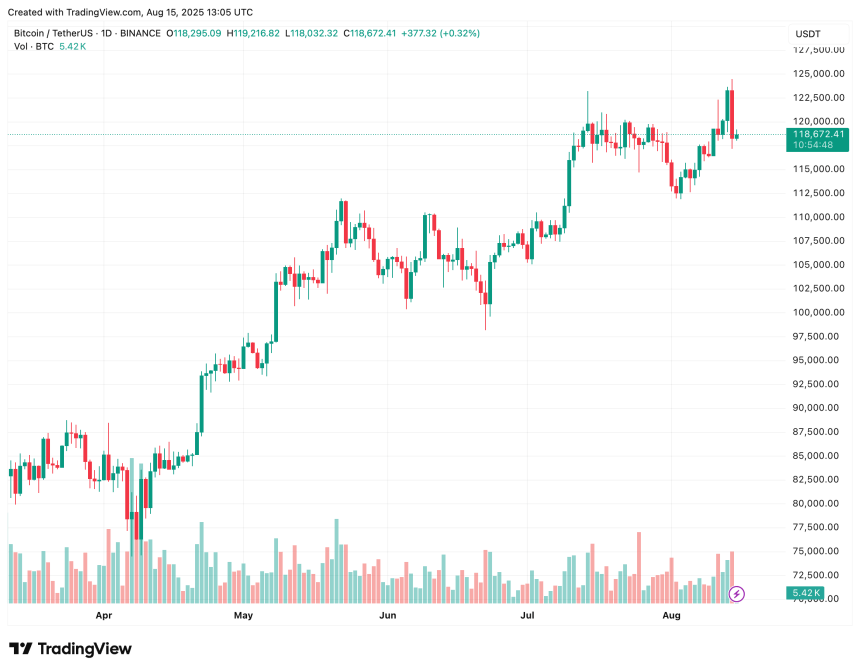

Adding to the caution, some analysts warn of a possible pullback to $110,000 to fill outstanding fair value gaps. At press time, BTC trades at $118,672, down 0.1% in the past 24 hours.

Bitcoin trades at $118,672 on the daily chart | Source: BTCUSDT on TradingView.com

Bitcoin trades at $118,672 on the daily chart | Source: BTCUSDT on TradingView.comFeatured image from Unsplash, charts from CryptoQuant and TradingView.com

English (US) ·

English (US) ·