Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in July 2025:

- Bitcoin – The world’s oldest and largest crypto

- Ethereum – The leading DeFi and smart contract platform

- XRP – The leading crypto remittance solution

- Solana – Smart contracts platform with high speeds and low fees

- Kaia – A fast-growing L1 chain designed for high performance and cross-chain integration

- Internet Computer – A decentralized blockchain designed to run full-stack Web3 apps

- Hyperliquid – Decentralized perpetuals exchange with an efficient order book

- Zcash – Privacy-focused cryptocurrency

- Arbitrum – Ethereum Layer 2 focused on speed, low fees, and full EVM compatibility

- Sui – Robust and highly scalable L1 blockchain

- Raydium – Solana-based DEX and AMM with order book integration

- BNB – The native coin of the Binance exchange

The best cryptos to buy right now: Discover top investments for July 2025

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin has reached a new all-time high of $123,191, rising nearly 12% over the past seven days and Bitcoin may be down 3% on the week, currently trading at $118,752, but the pullback hasn’t discouraged institutional accumulation. If anything, the appetite for BTC among funds and public companies appears to be intensifying.

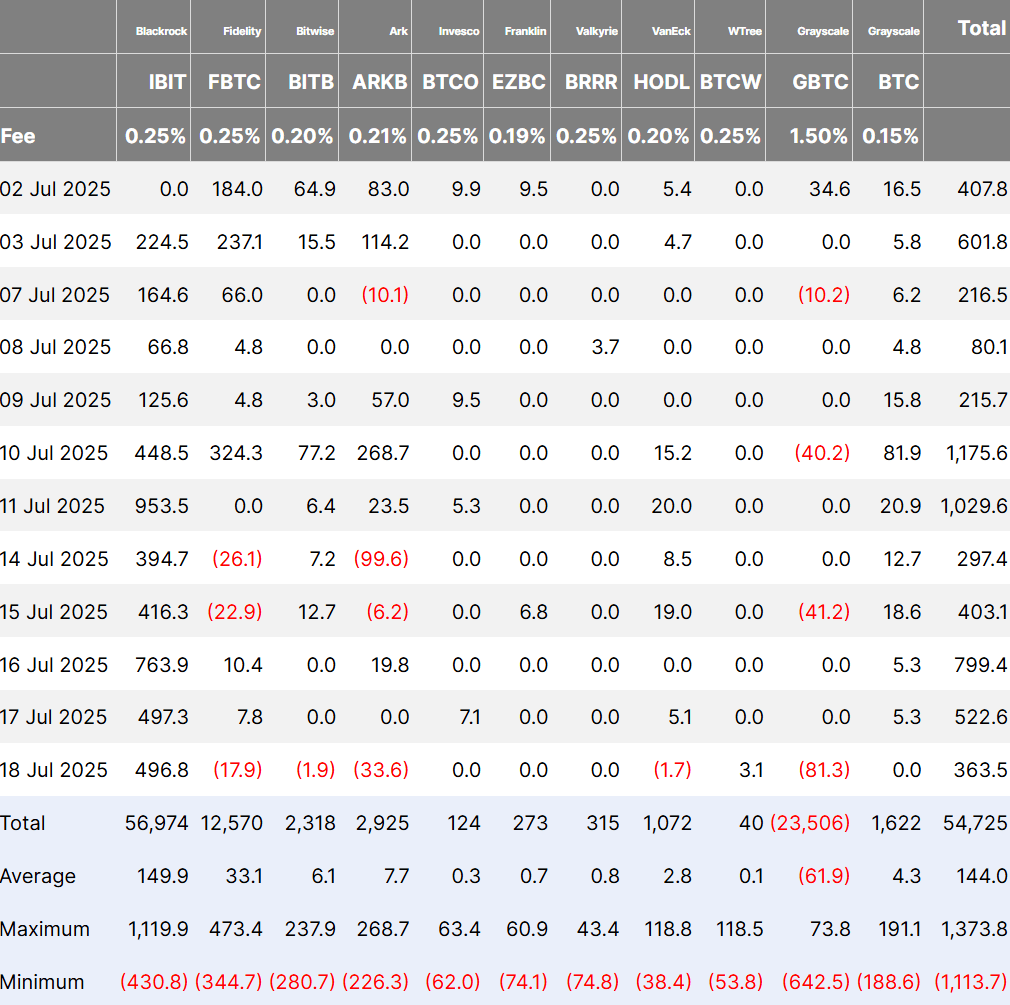

The clearest signal came from spot Bitcoin ETFs, which have now enjoyed 12 consecutive days of inflows, totaling over $6.6 billion during the stretch. BlackRock’s iShares fund alone pulled in nearly $500 million in a single day, cementing its lead among spot BTC ETFs with $86.5 billion in assets under management. The surge in ETF activity has helped push total AUM for the sector to $152 billion, now accounting for more than 6.5% of Bitcoin’s market cap.

Bitcoin ETF inflows/outflows in July. Source: Farside Investors

Meanwhile, Michael Saylor’s Strategy added to its already massive Bitcoin position, purchasing 6,220 BTC for $739.8 million last week at an average price of $118,940. With this buy, the firm now holds 607,770 BTC acquired for $43.6 billion, making it the largest public holder of Bitcoin by a wide margin. The purchase came as Bitcoin briefly touched a new all-time high above $122,000 before retreating slightly.

Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 $BTC acquired for ~$43.61 billion at ~$71,756 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/8z5HygrDWs

— Michael Saylor (@saylor) July 21, 2025Regulatory clarity is also helping fuel long-term confidence. Last week’s passage of three major U.S. crypto bills—covering market structure, stablecoin policy, and CBDC restrictions—was widely viewed as a turning point, with lawmakers signaling bipartisan support for a more defined crypto framework.

Thursday vote on the CLARITY Act. Source: US House of Representatives

2. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum has jumped more than 24% over the past week, rising to a high of $3,813 before settling just below at $3,776. A major driver behind the momentum is a wave of institutional interest—both through ETFs and direct exposure to on-chain ETH infrastructure.

One of the most headline-grabbing developments came from Ether Machine, a newly formed public entity that’s preparing to launch a $1.5 billion ETH yield fund. Led by former Consensys executives, the fund is expected to debut with over 400,000 ETH under management and will trade on Nasdaq under the ticker ETHM. Their strategy is generating ETH-denominated yield through staking, restaking, and active participation in DeFi protocols, marking one of the largest on-chain ETH positions ever held by a public company.

We are The Ether Machine.

Today we launch the largest public vehicle ever built to own and manage ETH with over $1.5B in committed capital.

This is Ethereum’s institutional chapter.

Not passive. Not synthetic. Not outsourced.

⬇️

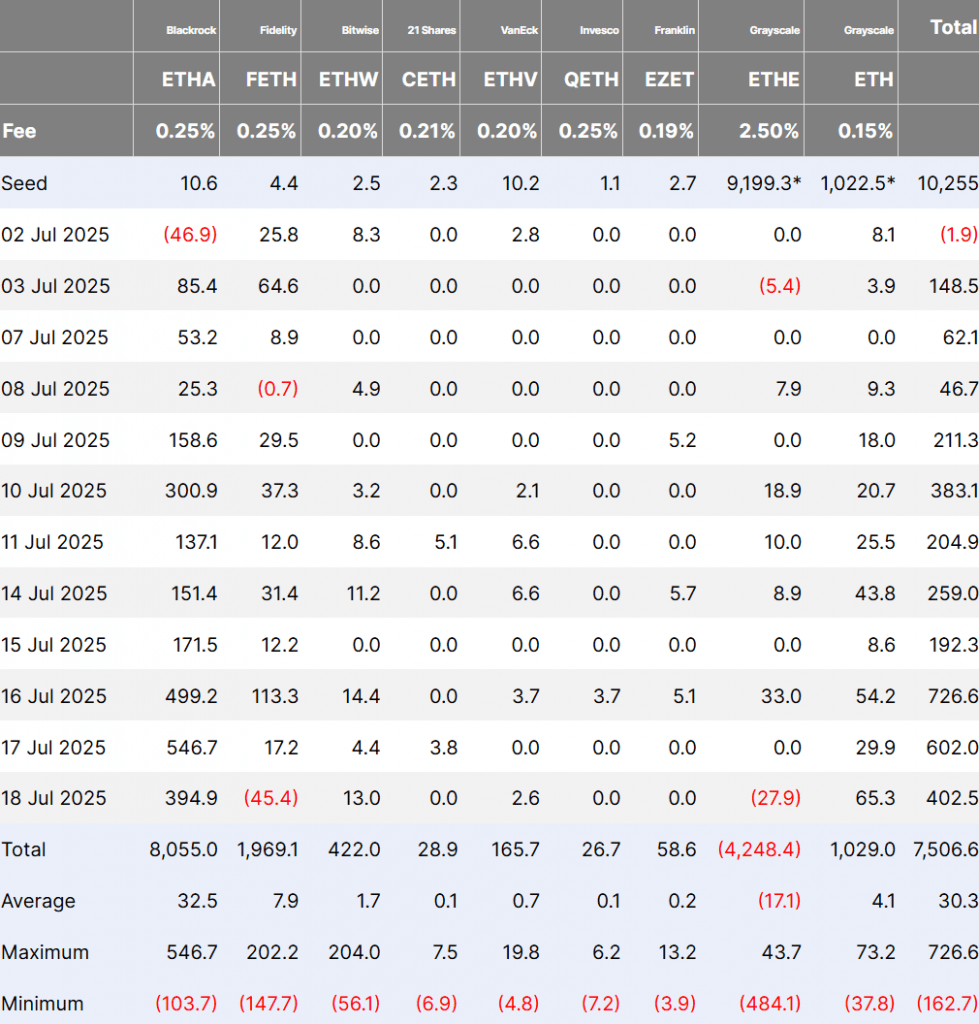

Meanwhile, Ether ETFs are enjoying their strongest run yet. According to CoinShares, Ethereum investment products saw record weekly inflows of $2.12 billion, helping push 2025’s total inflows past $6.2 billion—surpassing all of 2024. The 14-week streak of positive flows now accounts for 23% of total ETH assets under management in ETFs, showing institutional capital is finally leaning into ETH at scale.

Ethereum ETF inflows/outflows in July. Source: Farside Investors

On the protocol level, Ethereum is scaling to meet the moment. Gas limits climbed past 37 million, and nearly half of all validators are backing a new 45M target, which would increase L1 transaction throughput and lower network fees. The “pump the gas” campaign, backed by key Ethereum developers and validators, is helping prepare the network for its next phase of growth.

From ETF inflows and validator upgrades to the arrival of a major public ETH fund, Ethereum is stacking bullish catalysts at every level—and the next stop could be a clean break above $4,000.

3. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

XRP is currently priced at $3.52, up 18.42% over the past 7 days, having hit a new all-time high of $3.64, finally eclipsing its previous record from January 2018. The rally comes amid strong altcoin momentum and renewed institutional interest in the XRP Ledger (XRPL), whose daily transaction volume recently surged to $1.4 billion. With XRP flipping USDT to become the third-largest crypto by market cap at over $208 billion, bullish sentiment is high.

Much of the buzz surrounds Ripple’s positioning within the U.S. financial system. The recent GENIUS Act, now signed into law, gives stablecoin issuers like Ripple a regulatory green light, but experts caution the move will have minimal direct impact on XRP’s price. While Ripple’s RLUSD stablecoin could thrive domestically by competing with USDC and PayPal USD, XRP’s price remains largely decoupled from RLUSD adoption. Network fees in XRP are negligible, and only 14 million XRP have been burned since launch, which is insignificant compared to the 59.1 billion coins in circulation.

Despite the regulatory clarity for stablecoins, XRP’s own legal classification remains uncertain. The recently passed CLARITY Act could finally establish XRP’s status and determine whether Ripple can broaden its use case across tokenized assets. Until then, XRP continues to act primarily as a bridge currency, with its value driven more by market momentum than Ripple’s evolving infrastructure strategy.

4. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

Solana is trading around $153, showing renewed strength following the launch of the first U.S.-listed Solana staking ETF. The REX-Osprey ETF (ticker: SSK) debuted on July 3, ending its first trading day with $12 million in inflows and $33 million in volume. The fund gives investors exposure to spot SOL and staking yields, making it the first staking-enabled crypto ETF to hit U.S. markets. While it doesn’t follow the traditional spot ETF path, analysts see it as a workaround that reflects real demand—and a potential preview of what a full spot Solana ETF could look like.

Bloomberg analysts have now raised the odds of spot Solana, XRP, and Litecoin ETFs being approved by the end of 2025 to 95%, citing rising institutional interest and a favorable regulatory shift. On that note, Solana’s CME futures also saw record open interest, hitting $167 million, signaling that institutions are positioning early. The ETF didn’t move SOL’s price much at first, but traders are now watching for delayed momentum as more investors gain regulated access.

Get ready for a potential Alt Coin ETF Summer with Solana likely leading the way (as well as some basket products) via @JSeyff note this morning which includes fresh odds for all the spot ETFs. pic.twitter.com/UMzih4oou7

— Eric Balchunas (@EricBalchunas) June 10, 2025Separately, Solana just took the lead in one of the fastest-growing sectors in crypto: tokenized stock trading. The launch of the xStocks platform, built on Solana, pushed the network to capture over 95% of all tokenized equity trading volume across blockchains. Within days, xStocks reached $48.6 million in AUM, with more than 20,000 unique wallets holding tokenized stocks like SPYx, TSLAx, and METAx. While liquidity remains thin, the early adoption numbers are a strong signal that Solana is becoming a serious base layer for on-chain finance.

Solana onchain token stock volume skyrocketed in the past few days. Source: DuneAnalytics

Solana onchain token stock volume skyrocketed in the past few days. Source: DuneAnalyticsWith traction building in both regulated investment vehicles and DeFi use cases, Solana is emerging as one of the few Layer 1 platforms gaining relevance in both traditional and crypto-native markets. If macro conditions stay favorable and ETF momentum builds, SOL could break out of its current range and test January highs above $180 in the coming weeks.

5. Kaia

Kaia is a high-performance Layer 1 blockchain designed for speed, scalability, and seamless cross-chain interaction. Initially launched as part of the Klaytn ecosystem, Kaia emerged in 2024 following a strategic merger between Klaytn and Finschia—two major blockchain platforms backed by Korean tech giants Kakao and LINE, respectively. The goal behind Kaia is to create a unified infrastructure optimized for mass adoption in both Web2 and Web3 environments, particularly across Asia.

Kaia uses a Delegated Proof-of-Stake (DPoS) consensus mechanism that enables fast block times and low transaction fees, making it well-suited for high-throughput applications like gaming, NFTs, and consumer-facing dApps. Its architecture supports EVM compatibility, allowing developers to easily deploy existing Ethereum-based smart contracts with minimal adjustments.

One of Kaia’s core features is its strong emphasis on interoperability and regional adoption. The chain is built to connect various blockchain ecosystems while also partnering with enterprise players and public institutions to drive real-world use cases. Kaia’s governance is handled by the Kaia Council, a group of ecosystem partners responsible for key protocol decisions and treasury management.

Still in the early stages of expansion, Kaia is gaining attention for its steady price growth and rising on-chain activity. With strong backing, technical flexibility, and a focus on real-world integrations, it aims to become a major player in the next phase of blockchain adoption.

Why Kaia?

Kaia has surged from roughly $0.15 to $0.20 and is currently trading around $0.19. That’s about a 33% move in days, putting Kaia on the radar as one of the fastest-rising mid-cap tokens right now.

The rally gained a boost from Phase 2 of the $100K Kaia × KaitoAI Yapper campaign, which just kicked off. The campaign adds $38,200 in rewards—combining leftover funds from Phase 1 with a new $30K injection.

The race is back and this time, it’s bolder. 🔥

Phase 2 of the $100K Kaia x @KaitoAI Yapper campaign is now live.

💰 This round’s prize pool: $38.2K, combining Phase 1’s unclaimed rewards with a fresh $30K injection.

Missed your shot last time? Now’s the time. 🧵👇 pic.twitter.com/UPG7UCzyyC

Technically, Kaia broke through resistance around $0.17–$0.18, clearing the 50-day and 200-day averages on solid volume. Its RSI is climbing but not overheated, suggesting room for another leg up. Analysts point to bullish chart patterns, with possible targets up to $0.26–$0.30 if the rally continues.

On-chain activity supports the move too: Kaia’s TVL has jumped nearly 50% in the past 30 days to about $121 million, while stablecoin supply on its network rose to $41 million. These metrics show developers and users are engaging more, an encouraging sign for Kaia’s growth story.

6. Internet Computer

Internet Computer (ICP) is a decentralized blockchain developed by the Dfinity Foundation to host full-stack Web3 applications directly on-chain—without the need for centralized cloud providers. Launched in 2021, it enables developers to build scalable dApps using “canister smart contracts” that handle both logic and data, making it one of the only blockchains capable of serving content directly to end users.

ICP’s unique Chain-Key Technology allows native cross-chain integration with Bitcoin and Ethereum, enabling secure wrapped tokens like ckBTC and ckETH without relying on third-party bridges. This eliminates the risks typically associated with bridge hacks while enabling fast, low-cost transactions.

With near-instant finality, low fees, and native support for Web3 services, Internet Computer is gaining traction in DeFi, gaming, and AI-driven apps. The ICP token is used for staking, governance, and paying for computation across the network.

Why Internet Computer?

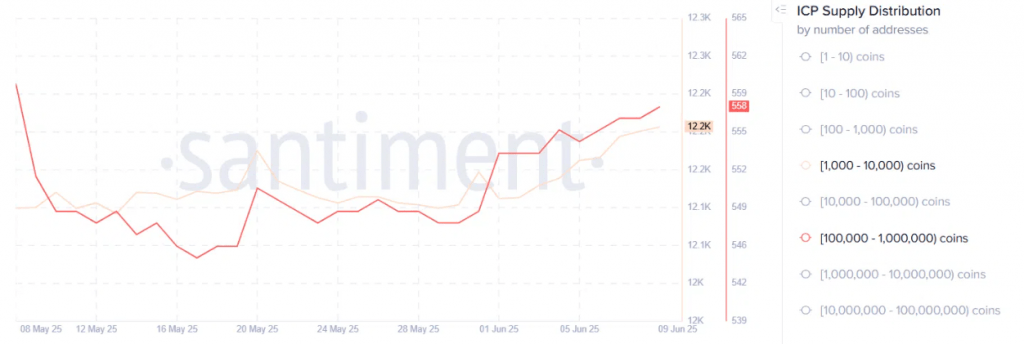

Internet Computer (ICP) is defying the broader market slowdown with a tech-fueled rally driven by its newly unveiled AI platform, Caffeine. The token is trading 32% above its yearly lows, having broken out of a months-long downtrend on the back of strong technical indicators, rising volume, and growing whale accumulation.

Caffeine, an AI-powered development platform introduced at the World Computer Summit, allows users to build blockchain apps via natural language commands—no coding required. This innovation drastically lowers the barrier to Web3 development and leverages ICP’s secure smart canister architecture for real-time application deployment.

Beyond AI, ICP is also making waves in cross-chain infrastructure. Its Chain-Key cryptography enables wrapped BTC, ETH, USDT, and USDC to function natively within the ICP ecosystem without third-party bridges—a solution that could eliminate the vulnerabilities responsible for over $2 billion in bridge-related hacks since 2021.

Technicals support the bullish case: ICP has reclaimed its 50-day SMA and MACD/RSI both show rising momentum. If the price breaks above the $6.88 level (23.6% Fib), the next target sits at $8.53—a potential 50% move from current levels.

7. Hyperliquid

Hyperliquid is a decentralized perpetual futures exchange built to rival centralized trading platforms in speed, liquidity, and user experience—all while remaining fully on-chain. Unlike traditional DEXs that often struggle with performance bottlenecks, Hyperliquid uses a custom high-performance layer-1 blockchain specifically optimized for trading. This allows it to offer ultra-low latency, high throughput, and a seamless trading experience without relying on external validators or rollups.

One of Hyperliquid’s key innovations is its order book-based model, which is uncommon among decentralized platforms. While many DEXs use automated market makers (AMMs), Hyperliquid implements a central limit order book (CLOB), giving traders more control over order execution and tighter spreads. This design makes it particularly appealing to professional and high-frequency traders who expect the responsiveness of centralized exchanges but want the trustlessness of DeFi. Its deep liquidity pools and tight integration with crypto-native assets further enhance its trading dynamics.

Why Hyperliquid?

Hyperliquid is having its breakout moment. HYPE, the protocol’s native token, has soared above $38, mimicking the explosive price structure Solana showed in early 2021 before a legendary rally. Technical analysts now project a potential 240% gain by July if the current pattern holds, with Fibonacci extension targets at $51 and even as high as $128 for the most bullish scenarios.

Friendly reminder that the new Hyperliquid fee system is now live. This means perps and spot fees are now different (spot fees count as double volume) and trading fee discounts for staked HYPE is officially active.

Check the Portfolio page for all the information!

Hyperliquid pic.twitter.com/pbjoepj5ga

This price action comes on the back of sustained momentum. Hyperliquid recently upgraded its fee structure to reward staked HYPE holders, further reducing the circulating supply and incentivizing long-term participation. The platform regularly processes over $100 million in daily volume and has achieved speeds of up to 200,000 transactions per second—clear evidence of both technical excellence and real user adoption. [Insert tweet: Steven.hl or Ansem on Hyperliquid’s fee changes or protocol stats]

Hyperliquid’s recent launch of HyperEVM has turbocharged ecosystem growth, allowing over 100 decentralized applications to go live across DeFi, GameFi, AI, and more. Popular analysts are comparing Hyperliquid to “Solana and FTX combined,” but with the critical difference that nearly all trading revenue goes directly to HYPE tokenholders, and the protocol is fully onchain.

With momentum building, strong fundamentals, and an eye-catching chart setup, Hyperliquid is increasingly positioned as one of the most compelling short-term bets in crypto. If the “Solana fractal” narrative gains further traction, HYPE could be the next token to capture widespread trader attention.

8. Zcash

ZCash (ZEC) is a privacy-focused cryptocurrency that was launched in 2016 by Zooko Wilcox-O’Hearn. It is a fork of Bitcoin, designed to enhance privacy and anonymity for its users. Unlike Bitcoin, where transaction details (such as sender, recipient, and amount) are publicly visible, ZCash allows users to choose between two types of transactions: transparent and shielded.

Transparent transactions work similarly to Bitcoin, where all transaction details are recorded on the blockchain and visible to everyone. However, shielded transactions use a cryptographic technology called zk-SNARKs to allow fully private transactions. In shielded transactions, the details are encrypted, meaning that only the parties involved have access to the information, while the validity of the transaction is still verifiable by the network.

ZCash is particularly valued by those who prioritize financial privacy and security, as it offers optional anonymity in a way that few other cryptocurrencies do.

Why Zcash?

Zcash has re-emerged as a top privacy play, jumping over 23% in the last week and 51% in the past month as the privacy coin sector quietly reclaimed a $10 billion market cap. With most major cryptos pausing, privacy coins like Zcash are lighting up the charts, reminding investors that demand for financial anonymity hasn’t faded.

This momentum isn’t just about price. Zcash just achieved a major technical milestone with its integration into the Maya Protocol, a decentralized, cross-chain liquidity network. For the first time, ZEC holders can permissionlessly swap their coins across multiple chains—no centralized exchange or account required. In a climate where regulatory scrutiny is pressuring exchanges to delist privacy coins, this direct DEX access makes Zcash both more accessible and future-proof.

With ZEC now live on Maya Protocol, Zcash gains native access to a permissionless, decentralized, cross-chain liquidity network for truly decentralized asset swaps. This means ZEC holders can swap between assets with multiple chains without relying on centralized exchanges. https://t.co/5QaSiZFCPF

— Zcash 🛡️ (@Zcash) May 21, 2025The partnership between Zcash and Maya is rooted in shared values—privacy, self-sovereignty, and decentralization. Unlike traditional platforms that require KYC and can ban assets at a moment’s notice, Maya enables truly open, censorship-resistant trading. Zcash’s upcoming Zashi wallet integration will take this further, bringing cross-chain shielded payments and Maya-powered swaps directly to mobile users in 2025.

With Zcash and other privacy coins gaining traction while liquidity remains limited due to centralized exchange bans, the Maya Protocol integration is a crucial hedge. It ensures ZEC users can move, trade, and spend—regardless of regulatory headwinds. In short: as privacy becomes harder to access, Zcash is building the tools and partnerships needed to keep it alive.

Ethereum reached a new all-time high, surpassing $900 billion. This is especially true for USDC, which exceeded $500 billion in transactions. This surge in stablecoin activity comes as major institutions, tech giants, and even political figures like Donald Trump show increasing interest in crypto. Visa’s recent expansion of stablecoin settlements and PayPal’s push with PYUSD underscore the growing role of blockchain in traditional finance. Meanwhile, Ethereum continues to dominate as the primary chain for stablecoin transactions, far outpacing competitors like Tron.

9. Arbitrum

Arbitrum is a Layer 2 scaling solution for Ethereum that aims to reduce transaction costs and improve speed without compromising on security. It uses a technology called Optimistic Rollups, which allows it to bundle large batches of transactions and settle them on Ethereum’s mainnet. This approach significantly lowers gas fees while maintaining Ethereum’s core decentralization and security guarantees.

Developed by Offchain Labs, Arbitrum launched its mainnet in 2021 and has quickly become one of the most widely adopted Layer 2 platforms. It is fully compatible with the Ethereum Virtual Machine (EVM), which makes it easy for developers to migrate or deploy smart contracts without needing to rewrite code. As a result, many popular DeFi protocols—including Uniswap, GMX, and Aave—have launched on Arbitrum.

Arbitrum’s ecosystem runs on two major networks: Arbitrum One, which is the general-purpose rollup chain, and Arbitrum Nova, which is optimized for ultra-low-cost, high-throughput applications like gaming and social apps. The platform’s native token, ARB, was launched in 2023 and is primarily used for governance via the Arbitrum DAO.

With growing developer activity, strong total value locked (TVL), and expanding support from major exchanges and wallets, Arbitrum continues to lead the Layer 2 space. It plays a key role in Ethereum’s broader scaling roadmap and is positioned to benefit as more users seek cheaper, faster alternatives to the Ethereum mainnet.

Why Arbitrum?

Arbitrum (ARB) is showing signs of a potential trend reversal after a choppy few weeks. The token started the week trading around $0.26, briefly spiked above $0.33 on June 24, then gradually slipped back toward $0.29–$0.30 before surging again at the end of the month. On June 30, ARB broke out sharply, peaking near $0.38, and has since stabilized just above $0.35. That’s a nearly 40% gain from its June 23 levels—one of the strongest performances among major Layer 2 tokens during the week.

Much of the renewed interest came from speculation around a potential partnership with Robinhood. While no official announcement has been made, a recent report highlighted growing rumors that Robinhood may be integrating Arbitrum into its crypto offering. That would be a big step forward in terms of retail accessibility, as Robinhood continues to expand beyond Bitcoin and Ethereum. The speculation alone was enough to spark a sharp uptick in volume and price.

Technically, the chart shows a clear breakout. After weeks of range-bound action, ARB managed to punch through its 50-day moving average on strong volume, forming a bullish engulfing pattern. Funding rates have flipped positive, and open interest is rising—two signs that traders are leaning bullish. As long as ARB holds above $0.34, the next resistance sits around $0.40, with potential for continuation if broader sentiment stays strong.

Momentum is also building within Arbitrum’s ecosystem. With major DEXes, yield protocols, and NFT platforms continuing to expand on Arbitrum One, the network has retained its place as a top Layer 2 by total value locked (TVL). If a retail gateway like Robinhood is confirmed, ARB could see a new wave of inflows—not just from speculators, but from users actually engaging with the chain.

10. Sui

Sui is a layer 1 blockchain focused on scalability and high throughput. Thanks to its robust performance, Sui is positioned to become one of the leading chains in the Web3 and NFT space, challenging the likes of Ethereum and Solana.

Smart contracts on the Sui blockchain are written in the Move programming language, a language developed by a team of Facebook developers who worked on the Diem stablecoin project. Move was first prominently used by the Aptos team, which features a lot of individuals who worked on the Diem project before it was shut down.

The native token of the Sui blockchain is called SUI. The token is used to pay gas fees for transactions, staking, and compensating validators for securing the network, for funding Sui’s storage fund, and for the Sui ecosystem governance.

Why Sui?

Sui has rapidly gained attention following a 65%+ price surge in just one week, driven by strong speculation and real ecosystem growth. A major catalyst has been rumors linking The Pokémon Company to Sui through its acquisition of Parasol Technologies, which recently appeared in Pokémon HOME’s privacy policy update. Although no official confirmation has been made, the mere possibility of Pokémon exploring web3 initiatives through Sui has ignited massive interest in the project.

Source: X

Source: XBeyond speculation, Sui is making meaningful strides in real-world adoption through a partnership with xPortal and xMoney. This collaboration enables over 2.5 million xPortal users to access a custom Sui wallet, spend SUI tokens at 20,000+ European merchants, and integrate with Apple Pay and Google Pay via a virtual Mastercard. With compliance, seamless UX, and real-world utility, Sui is positioning itself as a standout among layer 1 blockchains aiming for mainstream crypto payments.

Adding to its momentum, Sui’s broader ecosystem is also thriving, with projects like Suilend, DeepBook, and Navi Protocol posting triple-digit gains. These DeFi platforms highlight the growing liquidity and user engagement across the Sui network, suggesting that the recent rally isn’t just hype, but part of a deeper and expanding foundation.

11. Raydium

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain, designed to provide fast, low-cost, and efficient token swaps. Unlike typical AMMs, Raydium integrates directly with Serum, Solana’s order book-based DEX, giving it a unique hybrid model. This allows Raydium users to tap into the liquidity of Serum’s entire order book while also benefiting from the instant trades and yield farming features of traditional AMMs.

Raydium stands out for its capital efficiency and composability. Liquidity providers on Raydium not only earn fees from swaps but also gain exposure to broader market activity on Serum. Additionally, Raydium supports launchpads (via AcceleRaytor), dual yield farms, and ecosystem partnerships that help new projects bootstrap liquidity. Its ultra-fast transaction speeds—thanks to Solana’s architecture—make it a viable option for traders and projects seeking scalable DeFi infrastructure. The native token, RAY, is used for staking, governance, and participating in liquidity pools and launchpad events.

Why Raydium?

Raydium stands as one of the most important players in the Solana ecosystem, offering a dynamic blend of decentralized exchange functionality and liquidity provision. As the first AMM on Solana, Raydium has helped launch and support numerous projects by offering deep liquidity and a trusted launchpad. It holds a position similar to that of Uniswap in Ethereum’s early days, giving it a foundational role in Solana’s DeFi growth.

Built on Solana, Raydium inherits high-speed infrastructure with block times under 500ms and throughput of up to 65,000 TPS—far ahead of Ethereum’s capabilities. Since the start of 2024, the volume of trades on Raydium skyrocketed. At the same time, the total value of locked funds exploded, growing from $164 million TVL to over $1.2 billion TVL at the time of writing.

Source: DeFiLlama

Source: DeFiLlamaThe technical edge, combined with income-generating features like staking and yield farming, makes RAY more than just a speculative asset. It’s a utility-rich token embedded in a growing ecosystem, appealing to both DeFi enthusiasts and long-term investors looking for exposure to Solana’s momentum.

12. BNB

BNB (formerly Binance Coin) is a cryptocurrency created by the popular cryptocurrency exchange Binance. Binance is the largest cryptocurrency exchange in the world, allowing users to buy, sell, and trade a wide range of digital assets.

BNB was initially one of the ERC-20 tokens on the Ethereum blockchain but has since migrated to its own blockchain, known as BNB Chain. BNB is used as a utility token within the Binance ecosystem and has a variety of use cases. For example, users can use BNB to pay for transaction fees on the Binance exchange, receive discounts on trading fees, participate in token sales on Binance Launchpad, and purchase goods and services from merchants that accept BNB as payment.

One of the unique features of BNB is that it has a deflationary model. Binance uses a part of its profits each quarter to buy back and burn BNB tokens, reducing the total supply of the token over time. This mechanism is designed to create scarcity and increase the value of BNB over time, with the end goal of reducing the circulating supply of BNB from the initial 200 million to 100 million BNB.

Why BNB?

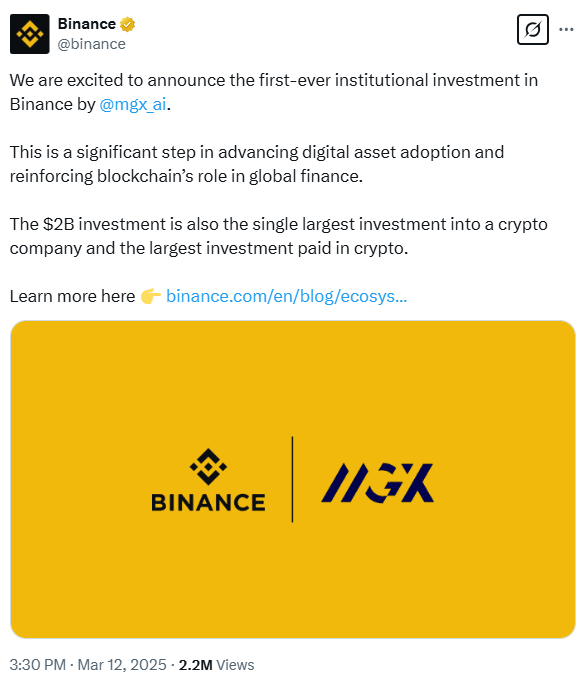

BNB has enjoyed quite a bit of market interest recently, having risen 13% between March 10 and March 17. There are several reasons for this, including the first-ever institutional investment in Binance and increased blockchain activity on the BNB Smart Chain.

Source: X (@Binance)

Source: X (@Binance)On March 12, Binance announced that the Abu Dhabi-based investment firm MGX committed to a $2 billion investment in the crypto exchange giant. “MGX’s investment in Binance reflects our commitment to advancing blockchain’s transformative potential for digital finance,” said Ahmed Yahia, Managing Director & CEO at MGX, and added that as institutional adoption accelerates, “the need for secure, compliant, and scalable blockchain infrastructure and solutions has never been greater.”

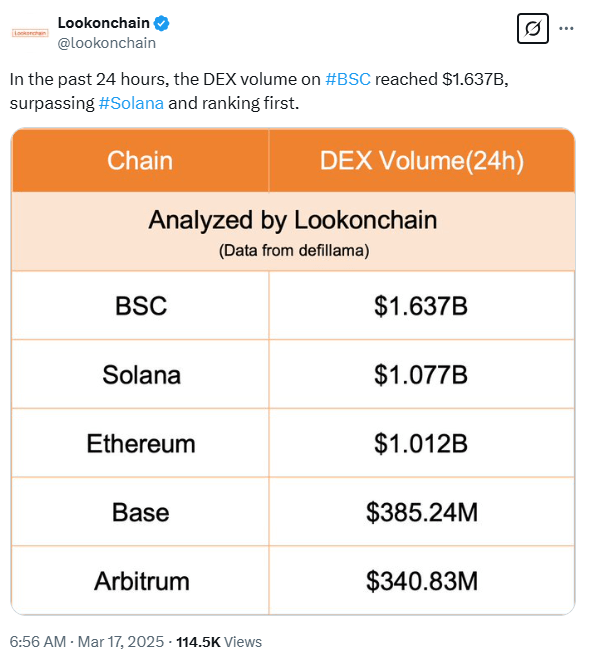

Meanwhile, the on-chain data shows that BNB Smart Chain has seen increased traffic when compared with other top smart contract platforms. As of March 17, BSC cleared over $1.6 billion in DEX trading volume, whereas Solana and Ethereum both trailed behind the first-placed BSC by roughly $600 million.

Source: X (@lookonchain)

Source: X (@lookonchain)It’s worth noting that the price and blockchain activity recorded a notable increase since the February roadmap release for 2025. In it, the BNB Chain team highlighted low latency, more types of transactions, elimination of potentially malicious MEVs, and smart wallet features as the main updates slated for this year.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $2.35 tln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $456 bln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $209 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $103 bln |

| Kaia | KAIA | 2024 | A fast-growing L1 chain designed for high performance | $1.06 bln |

| Internet Computer | ICP | 2021 | A decentralized blockchain designed to run full-stack Web3 apps | $3.24 bln |

| Hyperliquid | HYPE | 2024 | Decentralized perpetuals exchange with an efficient order book | $46.37bln |

| Zcash | ZEC | 2016 | Privacy-focused cryptocurrency | $721 mln |

| Arbitrum | ARB | 2023 | Ethereum Layer 2 focused on speed, low fees, and full EVM compatibility | $2.52 bln |

| Sui | SUI | 2023 | Robust and highly scalable L1 blockchain | $9.34 bln |

| Raydium | RAY | 2021 | Solana-based DEX and AMM with order book integration | $844 mln |

| BNB | BNB | 2017 | The native coin of the Binance exchange | $114 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $500 million as of spring of 2025)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.

English (US) ·

English (US) ·